By Jessica Feder-Birnbaum

As a licensed real estate agent, I’ve received countless distraught calls from prospective renters when apartments they have applied for have “fallen through.”

After submitting numerous client applications, I’ve learned several steps to take so an application doesn’t get denied.

Whether you work with a broker or search on your own, here’s what you need to know to prepare a winning rental application.

Qualifications

Do your homework. You don’t want to fall in love with an apartment only to find out that you’re not qualified. Before I meet with clients, I pre-screen them on the phone and only show apartments where I’m sure they’ll be approved. If you’re not working with a broker, speak to the management company to learn what their requirements are.

Landlords and Management companies can widely vary in what they ask for.

Some landlords require tenants and guarantors to have a credit score of 700+. Other landlords will accept additional security if credit isn’t strong. If you or your guarantors have no idea of your credit score you can request a free report from Experian, Equifax, or Transunion.

There are managements that require guarantors for Non-US citizens, while other managements will accept three to twelve months of extra security. Some landlords will only accept tri-state guarantors.

Most managements and landlords require tenants to earn 40x the monthly rent and guarantors to earn 80x the monthly rent. So, if an apartment is $2000 a month, the tenant(s) will need to earn $80,000 a year. The guarantor(s) will need to earn $160,000. If tenants or guarantors earn slightly below the 40x/80x the rent formula, some landlords will accept extra security while others won’t.

If you have a pet, make sure the building is pet friendly. There are buildings that are strictly pet-free to accommodate pet allergies. Some buildings allow any breed of dog or cat. Other buildings only allow cats. Some buildings are breed or weight restrictive. Others have a pet quota of one or two pets per apartments. If you are applying with a pet, have ready a photo, veterinary report, and for a dog, proof of license. Keep in mind that many buildings require a pet deposit ranging from $250

to $1000 and may charge a $50 per pet fee a month.

Filling Out The Application

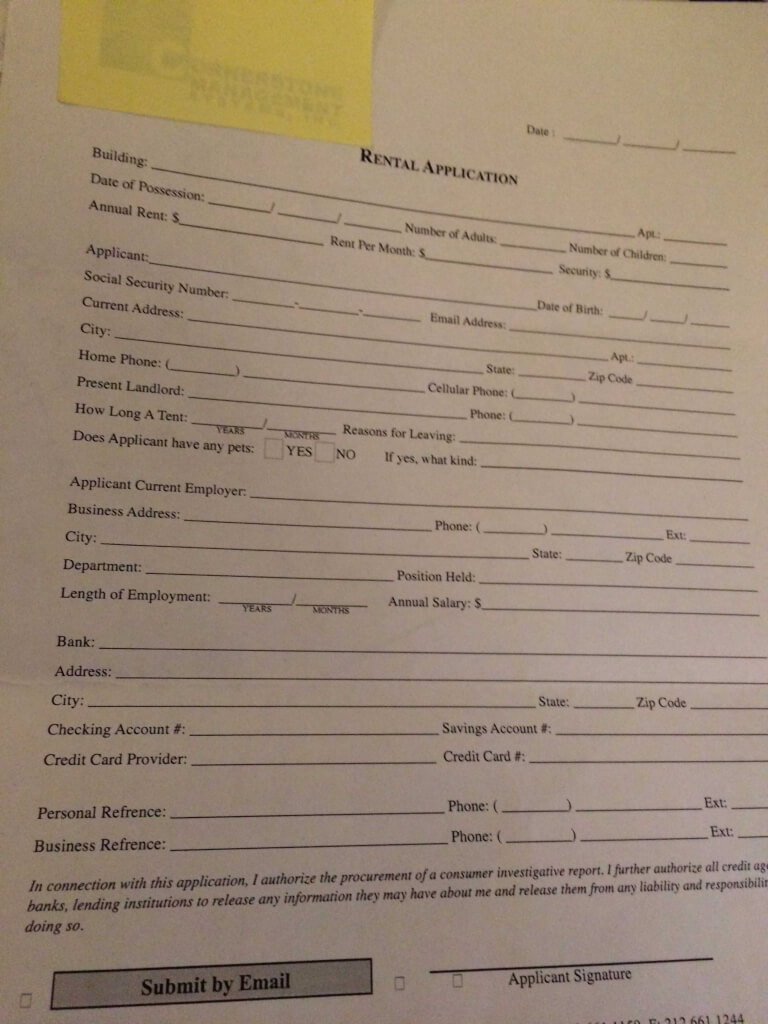

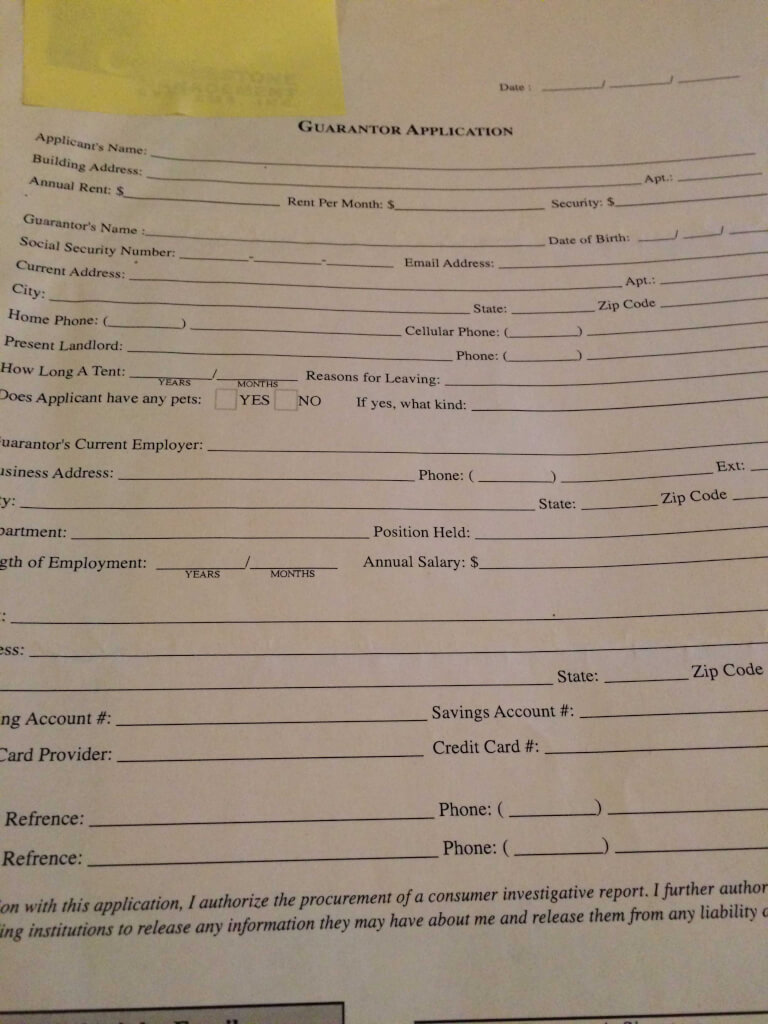

When you find an apartment you’d like to apply for, you must complete the application. A rental application is usually one to two pages.

Don’t leave any questions or lines blank. If you don’t know what to answer, ask the broker you’re working with, or if you’ve found a place on your own ask the management company for guidance.

Paperwork Requirements

Along with the completed application you will be asked to supply documents to verify your qualifications. If using a guarantor, guarantors will also need to provide these documents.

You’ll need a copy of a government issued photo ID such as a current US driver’s license or passport.

You’ll need a current (written in the past six months or less) letter of employment on company letterhead signed by a supervisor or administrator. This letter will state your job title, annual salary and length of employment.

If you’re a student, you’ll need to provide proof of enrollment, which may be a University acceptance letter, an official document from the bursar’s office, and a current course enrollment list.

If you’re self employed or retired, you’ll need a signed CPA letter on CPA letterhead, stating your annual salary and/or that you have the necessary funds to cover the rent and can offer proof of such funds via liquid assets such as mutual funds, stocks and bonds.

You’ll need to supply two to three of your most recent paystubs as well as your two most recent bank statements. Landlords are looking to see that there’s a positive balance in the account where you do your daily banking.

You will need to provide the first two pages of your most recent tax return. Some management companies will request tax returns going back two years. If you haven’t filed taxes, you will need to provide a tax extension form along with A CPA letter verifying annual income.

Other requested paperwork requirements may include landlord reference letters, bank reference letters, business and personal reference letters, additional investment accounts, and for guarantors, proof of home ownership.

Fees

A non-refundable fee to run a credit and background check is required with the application. The cost is usually $100. Though credit check fees may range from $75 to $125. Payment will either be cash, certified check or if paying online, credit card. Some landlords will take a refundable good faith deposit of $500 to take the apartment off the market. Others management companies will ask for a month’s rent to hold the apartment while the application is being processed.

If the application is denied, the good faith and rent deposits will be returned.

When the application is accepted the good faith deposit may be returned or applied toward the first month’s rent. If the deposit is the full month’s rent that will be kept as the first month’s rent by the landlord. However, if you are accepted for tenancy and choose not to sign a lease, managements will keep the deposits because their acceptance of your application prevented the apartment from being rented by another party.

If working with a broker, the broker may collect a fee from you for services rendered. In some cases the landlord pays the broker.

Submitting The Application

Landlords and managements have different submission policies. Fees, unless being paid online by credit card, will need to be submitted in person. There are managements that require all applications and supporting documents to also be submitted in person. Other managements will allow applications and paperwork to be scanned and sent by email. There are online applications, where the application is filled out through a management’s website, and supporting documents are then uploaded.

Time Is Of The Essence

Have all paperwork and fees ready to submit with a completed application. This especially holds true when applying with roommates. Though each roommate will have to pay an individual non-refundable credit check fee, the good faith deposit or first month’s holding rent is only paid once, and those costs may be split. Some (not all) management companies allow a 24-hour grace period to gather all documents. To play it safe, it’s best to submit applications, paperwork and fees at the same time.

Trouble Shooting

There may be application hiccups. Here are some common dilemmas with fixable solutions.

What if your supervisor is out of town and you don’t have a current letter of employment? There are boilerplate templates on the Internet. With your supervisor’s permission, you or your broker can write an employment letter. Print it up on company letterhead and have it signed by someone in your company’s HR department.

There are also boilerplates available for CPA letters, bank and landlord reference letters. Having a pre-written letter ready for signature will expedite the paperwork process.

What if you’ve just graduated college and are living with family and this is your first apartment rental?

If a landlord reference letter is required, you can get a letter (or use a boilerplate) on your University’s letterhead and have a resident advisor sign it. Or a family member can write a letter on your behalf stating that you’re a cooperative and responsible resident.

If you’re a Non-US citizen and don’t have a landlord reference letter, a business or personal reference letter may be substituted.

What if there are multiple applications for the same apartment? Some landlords accept one application at a time while others accept several and select the strongest application. You should find out beforehand what the landlord’s application policies are.

If you choose to apply for an apartment where several applications are simultaneously being reviewed, be sure to submit a complete application package to give yourself an advantage. Otherwise, only apply for apartments where one application is considered at a time.

What if you need a guarantor and don’t have one? The landlord may accept extra security or you may be able to use a lease guarantor service, where for a fee, the guarantor service will guarantee the lease for you.

What if you have a housing court violation? This will be discovered when a management company does a background check. So it’s best to initially disclose this information, so you may be steered toward more tolerant small landlords than larger management companies.

Waiting For Approval

While an application is being reviewed, in some cases more documents such as W-2 forms, investment funds, or an older tax return may be requested.

Approval generally takes one to three business days. Some landlords approve on the spot, while others rely on off-site screening services to verify documentation.

So now that you know the keys to submitting a successful application, don’t be surprised when a landlord hands you a set of keys to your new apartment.

Be Heard at Go Home NY

Be heard! Leave your apartment, condo, and coop building reviews at Go Home NY! Know a building's managers are awful? Have the inside line on a perfect building? Anything in between? Express your voice and be heard. Leave a review at Go Home NY.

Before you search for your new home, be sure to check out GoHomeNY to read the latest building reviews and learn more about great New York City neighborhoods to live.

Be Heard at Go Home NY

Be heard! Leave your apartment, condo, and coop building reviews at Go Home NY! Know a building's managers are awful? Have the inside line on a perfect building? Anything in between? Express your voice and be heard. Leave a review at Go Home NY.